US railroad Union Pacific has submitted a bid to acquire Norfolk Southern, with the aim of forming the first transcontinental freight rail network under one company in the United States.

For a sum of $85 billion (approximately €74 billion at today’s exchange rate), the possible takeover would represent an unprecedented reorganisation of the North American railway sector, traditionally divided between operators in the west and east of the country.

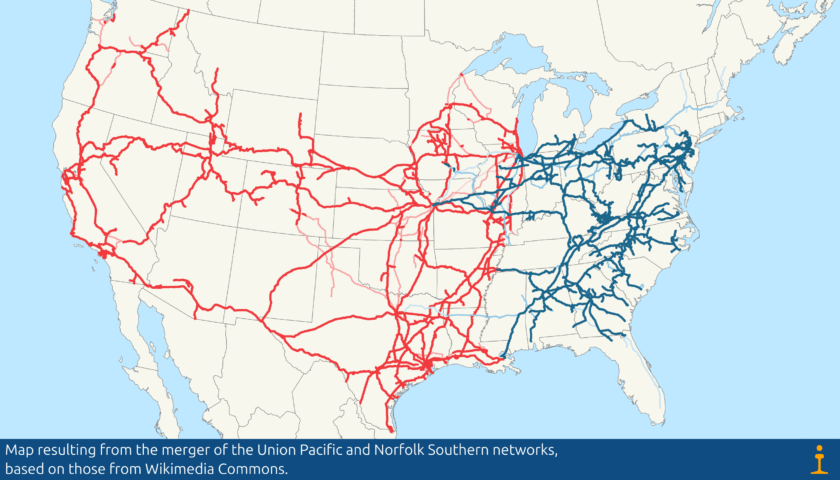

Linking the two networks would allow Union Pacific, dominant in the west, to integrate Norfolk Southern’s eastbound routes, eliminating the need for intermediate transfers of freight between the two coasts.

Con Trenvista Premium, disfruta de una experiencia sin anuncios y acceso a contenido exclusivo.

Únete por sólo 35€ al año y aprovecha ventajas exclusivas diseñadas para personas expertas en el ferrocarril.

★ Descubre Trenvista Premium

The resulting network would total more than 50,000 miles (80,500 kilometres) of track and a fleet of more than 10,300 locomotives and 134,000 wagons.

The merger of the Union Pacific and Norfolk Southern networks will shorten delivery times and reduce costs.

According to Union Pacific CEO Jim Vena, the deal aims to improve the efficiency and competitiveness of the US railway. This operation will shorten delivery times and reduce costs, with examples such as the direct transport of steel from Pittsburgh to California or lumber from the northwest to eastern markets.

The move is partly a response to the evolution of the sector: in the 1980s, there were more than 30 large operators, compared to six today after decades of acquisitions and mergers.

The immediate precedent is the 2023 merger between Canadian Pacific and Kansas City Southern, which resulted in the first operator with a direct presence from Canada to Mexico. However, the scale of this integration far exceeds the previous one, and poses enormous technical, commercial and regulatory challenges.

The logistics industry and large customers, such as Amazon or UPS, welcome the potential improvement in reliability and speed of services. However, other customers – especially chemical industries and large plants – are wary of the risk of loss of competition and higher fares. As demonstrated by historical experience, major rail mergers have occasionally resulted in operational issues and deteriorating service, as was the case following Union Pacific’s 1996 acquisition of Southern Pacific and Conrail’s split between Norfolk Southern and CSX.

Approval of the purchase could take years

The deal is still subject to approval by the Surface Transportation Board (STB) and the US antitrust authorities. Due to previous episodes of saturation and chaos following mergers, the criteria could be very restrictive.

All indications are that the regulatory process could drag on for years. And, if finally authorised, it could push the other two major North American operators – BNSF (a subsidiary of Berkshire Hathaway) and CSX – to also consider a merger, creating a scenario of only two major rail players in the US.

Union Pacific’s offer represents a premium to Norfolk Southern shareholders over its recent share price, with a combination of cash and shares estimated to be worth around $320 per share.

The companies plan to file the formal application within six months and aim to close the merger in early 2027, although the outcome will ultimately depend on complex and demanding regulatory scrutiny.

The US rail industry, which is crucial for the transportation of approximately 30% of the nation’s total weight, is currently in the midst of a potential transformation that is unprecedented since the laying of the Golden Spike in 1869. Additionally, there is a significant debate regarding the logistics model of the future, efficiency, and competition.